- Location

- West Bountiful, UT

I have been watching my returns in my Vanguard 401k and over the last 3 months, each month I lowered the amounts I've had in the slower performing investments and moved those percentages into the higher performing ones.

I just went the other way

I'm just a dollar cost averaging, index fund buying, Graham believer, Dalio asset allocation emulating drone. I try hard not to apply any imagination whatsoever to my retirement investments.

I rebalance by the calendar, every six months.

And I embrace the fact that I absolutely can not predict the future and have no idea what is going to happen.

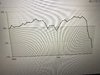

But, longest bull market in history. Best year I've ever had in returns and real dollars (my overall portfolio earned 28.8% in 2019). I decided it was time to take a big chunk of my winnings off the table and hedge. So I dumped 60% of my four highest earning funds (mid caps and global tech funds, they each did over 30% in 2019) and moved that all to bonds. Took my over all allocation from 75/25 common stocks/bonds to 50/50.

I'm not totally comfortable with it. If interest rates go up, my bond holdings aren't going to fare so well. They won't take a real beating, the coupon rate offers protection against that, but they could lose a little bit if rates go up. I don't know if there has ever been a strong bull market without inflation and super low rates like we have right now. It's like the stocks/bonds counter cycle is broken. So it doesn't feel like anywhere is safe.

So, I really agonized over it.

When the bear market does come though, rates will very likely go down and in that situation, my bonds will do well.

I've also reversed my contribution allocations to now go 25/75 stocks to bonds. You're supposed to buy low and sell high. It's all about getting stocks at the right price. You aren't supposed to buy just because a stock is going up and you aren't supposed to sell just because they are going down. Just the opposite. They are selling for record highs right now. So, I sold a bunch at the highest price they have ever sold. And have all but stopped buying. I'll start buying again the next time there is a big drop. Whenever that is, six months, a year, two years, three years. Whenever it happens I'll start to buy again and push a big chunk of the principle I just protected back in. I think I'm mostly done buying in this bull market though, the price is just too high. Q4 was just too nutty. I don't know the future, but that shit just can't be sustainable.

But I think it's a solidly conservative move. I'm not attempting to time the market. I'm just trying to protect some big wins, and hedge against a heavy downside if the market turns without too severely limiting upside. I'll hold pat for at least 18 months - until after the election.

But, I have a limited window. I need to be thinking about protecting wins. I want to retire in 10 years. All I need is to maintain my current contribution level and a steady 8% from here to reach my goal of a six figure retirement income. If I was younger, I'd be much more risk tolerant. But I can imagine myself holding 75% bonds and only 25% stocks five years from now.

- DAA